- Mingdom

- Posts

- Mingdom Capital 2025 Q2 Update

Mingdom Capital 2025 Q2 Update

Extreme Greed is back... but this time I'm Bullish?

In this issue:

Portfolio Performance

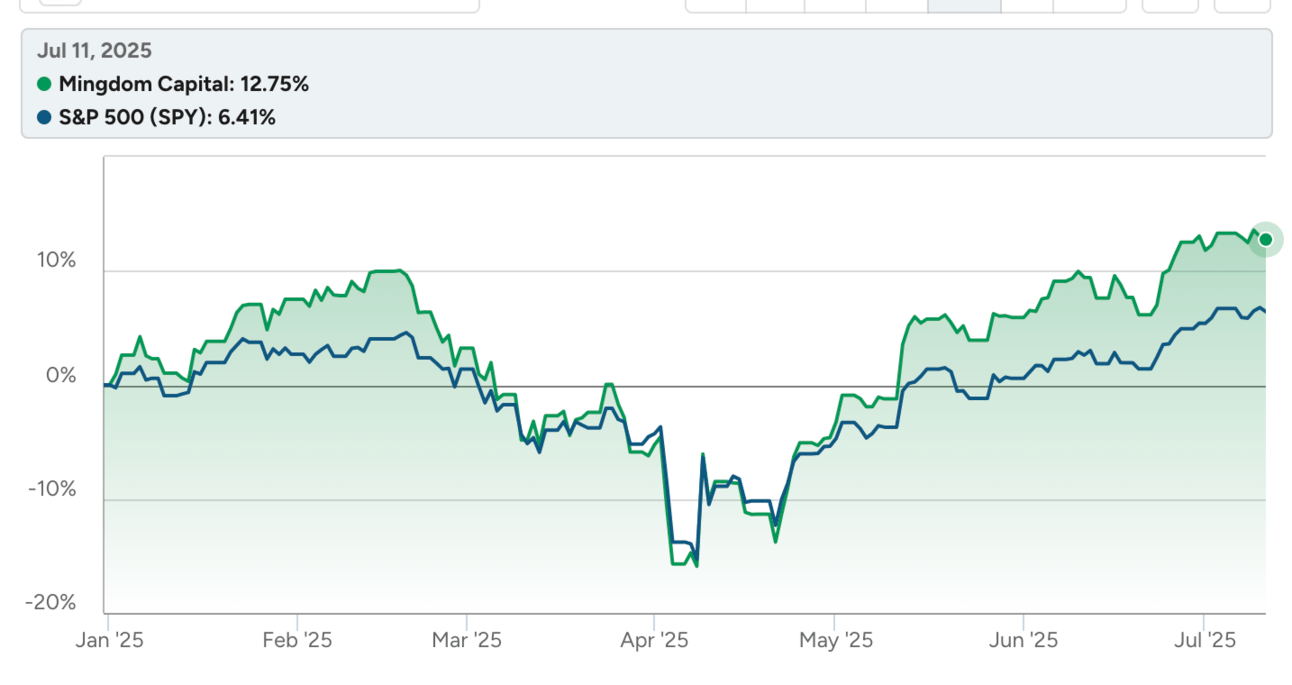

The Mingdom Capital portfolio is back to ATH with a 12.75% YTD after a brutal 23.5% drawdown in April. The fund achieved a 46% performance since inception compared to SPY at 26% and QQQ at 29%.

Performance between 2/1/2024 and 7/11/2025

YTD Perf vs. SPY

YTD Perf vs. QQQ

I give myself a B- for this performance. While I’m pleased to be beating both SPY & QQQ again YTD, the extreme drawdown and my handling of it leaves room for improvement. More on this in the What I learned section below.

Top Positions Analysis

Top 10 positions now accounts for 74.5%, up from ~70% from earlier this year. But I’m actually going to deep dive on the top 13 positions today as the allocation drop off sharply after these.

Top 13 positions

I wrote at the beginning of the year that my top 10 position GOOGL, META, AMZN, AXP, UBER, MA, NVDA, APP, BKNG, MELI, so there have been some changes. Notably:

Sold AXP to consolidate more into MA which IMO is a higher quality company.

TSM has now overtaken NVDA as the top semiconductor stock

APP no longer a top 10 position, I held through its massive 60% drawdown then trimmed it.

MSFT made the top 10! I was surprised at how well their cloud business is doing from the last quarter’s earnings. The tariff dip gave me a reasonable entry-point.

Reduced APP. There was a well-timed short seller attack on the company just as the tariff dip was happening, caused a 60% drawdown in the stock. It used to be my 8th largest position simply because of how much it appreciated in the portfolio. I held through the drawdown and trimmed as it bounced back. I did this to reduce risk and volatility to my portfolio, no plan to sell as long as they are executing well.

ASML and INTU are now two core holdings but not in the top 10. Both up about 10% since purchase.

Stats for Geeks

Now let’s take a deeper look at these 13 companies which I consider as core holdings of the portfolio. Feel free to skip this section if you don’t care about these more technical details.

Stock Performance

My top two positions in GOOGL and AMZN were actually biggest laggard in performance so far this year. Hopefully that turns around soon. Thankfully they were more than offset by the high performance from the other stocks.

Profitability Metrics

Notice any patterns? All of these companies are very profitable and FCF positive. High Return on Assets (ROA) is also a sign of moat as it implies that the company can consistently re-invest their profits to create more profits. This is what compounding is all about! ROA of over 10% is considered good, NVDA has 61%! Very strong moat.

Valuation Metrics

Growth Metrics

I know that’s a lot of numbers but I like to look at valuation metrics in context of the growth. A few observations:

Google is like not dying? Its current year revenue and next year’s revenue are both above its 3Y average revenue. LLMs have been out for more than 3 years now so the narrative that Google is dying is simply false from a financial perspective. Meanwhile its price ratio is much lower than peers like META and MSFT which I also own.

NVDA is the most expensive company I hold by most valuation metrics. But it grew revenue by 86% YoY and EPS by 81%… and we already talked about how crazy profitable/high moat it is. So maybe it’s justified?

UBER is turning massively profitable. It’s the cheapest company by current year P/E. I think it has lots more room to run.

Retrospective / What did I learn?

Last time I made the following predictions, let’s first grade these in turn:

The AI bubble is not ready to burst yet, it’s still super early and will lead to huge productivity gains over the long term. In addition, I’m betting decent chunks of my portfolio that Nvidia and TSMC will maintain their leadership positions in the semis space. This is in face of extreme negativity in the semiconductors space with the SMH now in a bear market, down over 20% from its peak value.

A+: NVDA & TSM bounced back huge and especially from the tariff lows. I’ll bucket ASML in with them as well, ASML and TSM are basically monopolies with the widest of moats. Semiconductor stocks in general now leaders in the current market cycle again.

We will not go into a recession in 2025. A recession is defined by having two consecutive quarters of negative GDP growth, I bet we won’t even have one.

A+: Recession chance according to prediction market was around 40% when I made this prediction, it rose to over 60% at its peak, and it’s now down to 20%. I made a few bucks in the prediction markets betting against the recession ;)

Google will emerge as one of the biggest winners from AI. Right now they are seeing as the main company to be disrupted by it since everyone is rolling out their own search engine and AI replaces the need to search with AI answers. I bet their search revenue will remain strong with moderate growth while they leverage AI to fuel much higher growth in other parts of their business.

B: Google’s recent I/O event showed them firing on all cylinders. They now have the frontier models in most categories. Veo 3 in particular got a lot of attention for generating by far the best videos and demonstrating real understanding of the world. Gemini and Google AI Overview appears to be taking shares from competitors as well (see below). They seem to be finally moving fast again, just check out how many AI experiments they have going at Google Labs. The reason for the B grade is simply that the stock is underperforming so far this year and they haven’t convinced enough investors that they are winning yet.

The rise of $GOOGL ‘s Gemini in Q2 is something that is not emphasized enough.

— Rihard Jarc (@RihardJarc)

1:19 PM • Jul 11, 2025

GenAI Traffic Share Update —

🗓️ 12 months ago:

ChatGPT: 84.4%

Google: 8.9%

Perplexity: 1.4%

Claude: 1.9%

Microsoft: 0.9%🗓️ 6 months ago:

ChatGPT: 86.7%

Google: 5.7%

Perplexity: 1.9%

Claude: 1.5%

Microsoft: 1.5%

DeepSeek: 0.7%🗓️ 3 months ago:

ChatGPT:— Similarweb (@Similarweb)

12:20 PM • Jul 9, 2025

Market has already priced in the worst case for tariffs ahead of April 2. This is a shorter term prediction but I think markets will actually rally after April 2 when tariffs actually go into place. I place no conviction on this one and it’s mostly wishful thinking that shouldn’t have major long term impact on my portfolio if the other predictions are right.

Had I written that prediction a week later on April 7th it would have been a slam dunk =P But yeah I was totally wrong at the end of March that the tariff news was already priced in. Market dropped significantly more when Trump announced worse than expected terms on basically every country. We eventually bounced back to ATHs but that’s because Trump showed his cards that he cares about the stock and bond market and paused tariffs to give more time to make deals.

The last quarter was excruciating at times, and I think I learned a lot and grew as an investor. Here are some of my take-aways in no particular order:

Speculating on macro is fun but I should focus way more of time on making sure the individual companies I own are doing well. Use volatility as an opportunity to accumulate shares in the best businesses at a lower price.

Psychology is so important. I mean I knew this and I knew I should be greedy when there was extreme fear, but honestly I got more conservative as the market was tanking and that’s the main reason why the fund hasn’t outperformed even more.

On hedging - I am increasingly of the opinion that I should not bother to hedge against market downturns. This is a more specific version of the last point. The main issue is that it’s very hard to time hedges appropriately. And even if I am right and the market goes down more, when do you close the hedge? So basically in order for hedging to work you have to time it right twice. This doesn’t show up in the SavvyTrader portfolio since it’s only stocks but in my personal portfolio I tried hedging by using options as well as directly shorting the indices while the market was going down and made a LOT of money initially, then the hedges got completely busted with the announcement of the tariff pause and the insane V shaped recovery we got after that.

On trading - I am trading much more frequently but I accept that I’m doing it more for fun and learning than anything else. I started a separate account for pure trading to keep it separate from my core investments. The key difference between investors and traders is that investors spend a lot more time researching the fundamentals of a business and will buy/accumulate as the price drops where as traders generally try to ride the momentum and won’t touch stocks that are below key moving averages. I actually have come to respect trading and professional traders a lot more recently and I’m putting a small % of my assets to pursue trading myself. This is one of the luxuries of being retired early I guess =)

On technical analysis - I use it way more and this goes hand in hand with the last point. It’s abundantly clear that perhaps the majority of active market participants (i.e. most of the volume per day) come from traders rather than investors and knowing the basics of technical analysis can really help decide when to enter or exit a position. I think even as long term investors, it pays to understand the basics of technical analysis.

Next, let’s go over my thoughts on the market and predictions looking forward.

Thoughts on the market

As I hinted in the subtitle, I’m bullish!

My base case assumption is that we are 3 months into a new bull market driven by AI. The biggest and most immediate beneficiaries of these will be big tech - they are already cutting cost via layoffs while being more productive than ever. It’s abundantly clear to me that coding agents have gotten much better over the last year and the entire focus of every frontier AI lab is to improve them further. Their goal is to get AI to the point of being able to do the job of an AI researcher on a quest to reach super intelligence.

This obviously does not bode well for the average software engineers and soon even the above average software engineers. Companies are now paying extreme dollars for top AI researchers and laying off average performers. I think the next few years every employable tech worker should aim to make as much money as possible because I seriously don’t know how long this can last.

But I digress… the point is that AI will lead to more extreme outcomes… and this is a good thing for investors because we get to invest in these extreme outcomes.

The Big Beautiful Bill (BBB) that was just passed seemed overall very positive for investors even if it’s inflationary. The thing to understand here is that the economy doesn’t have to be great for companies to do well. BBB permanently extended corporate tax cuts which will directly translate into higher earnings. There’s also a program now to fund investment accounts for newborns in America to buy into the S&P.

The current administration is also more favorable to IPOs and acquisitions. Money that was previously locked up in the private market now can return to investors to be reinvested in other things. Nearly every IPO is “successful” right now, as demand outweighs supply for the new IPO shares. For example, I was lucky enough to get a few shares in the Circle (CRCL) IPO and the stock went from $31 to nearly $300 in a couple of weeks. This is an extreme example but every IPO stock seems to be bought up. (Note: IPOs I participate in are purely speculative and not part of the public Mingdom Capital portfolio)

At the same time, there are reasons to be cautious as we are now in Extreme Greed territory and there are clear signs of euphoria. Among these, we can see that speculative companies are once again leaders in the market. Cathie Woods’ ARKK is cool again. Quantum stocks 10x’d this year with no working product or revenue. Cypto/BTC hit ATH.

I think in the past I would be more cautious and leave more cash on the sidelines but now I’m more of the mindset that I may as well take advantage of this market while it lasts. Again, this is with the base assumption that a new bull market is just starting. Nasdaq technically went into a bear market very briefly during the tariff drawdown and my portfolio most closely tracks the Nasdaq. Average bull market length is measured in years and I really think we are just at the beginning of the productivity improvement curve with AI. Of course, I will continue to avoid unprofitable companies or companies with no long term moat in the Mingdom Capital portfolio.

Perhaps the most important thing to keep remind myself is that to keep an open mind. Have an assumption, make bold predictions but be open to changing my mind with new data. Yes, that means I would even sell Google one day if they show signs of being truly displaced by competitors. Right now, the data is simply not there.

„Google is dead“

$GOOGL:

— THE SHORT BEAR (@TheShortBear)

10:36 AM • Jul 9, 2025

Reply